The Real Cost of Moving Freight. Truck Insurance Up 40% and Your Drivers Are Now Underwriting Risk.

How Non-Domiciled CDL Restrictions, English Language Proficiency Violations, Third-Party Litigation Financing, and Immigration Policy Are Reshaping Underwriting Risk for Motor Carriers

Non-Domiciled CDL Crackdown, English Proficiency Enforcement, Immigration Status and Driver Qualification Will Become the New Premium Multiplier.

Your insurance renewal isn’t just about your safety record anymore. It’s about who’s behind the wheel and whether they meet the new federal definition of a “qualified driver.” Most carriers haven’t connected these dots yet, but insurance underwriters already have.

Annual premiums for owner-operators and small fleets now average $11,000-$17,000 per truck. Bodily injury costs from truck crashes climbed 40% between 2018 and 2022. What’s new? FMCSA’s crackdown on 200,000 non-domiciled CDLs and strict English Language Proficiency enforcement means your driver qualification files are now underwriting risk factors that can increase your premiums 15-25% or get you declined entirely.

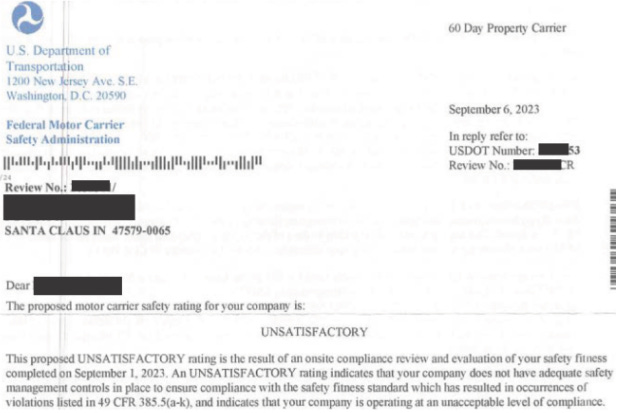

Part of what keeps me up at night is fleets that don’t grasp the gravity of how compliance affects their fleets from both an insurance renewal standpoint and a licensing standpoint. This is an Unsatisfactory Rating from the FMCSA. Carrier had 120 drivers who were out of work when the company was closed for compliance failures. Can you survive 45-120 days without revenue? Will your drivers wait for you to get upgraded? I spend more time helping carriers get upgraded each year than on anything else, except for expert witness litigation work. All of my time is spent each year helping carriers defend themselves and maintain their scores, so drivers and their families can continue working. It’s more serious than people think.

The Premium Explosion

The data on premium increases is undeniable, and it’s coming from every corner of the insurance industry.

Willis Towers Watson’s Commercial Lines Insurance Pricing Survey tracks year-over-year premium changes directly from carriers. Their Q2 2024 Casualty Insights & Analytics database showed loss-sensitive clients experienced their 32nd consecutive quarter of positive rate increases, with automobile liability averaging +6.4% in Q2 2024 alone. Willis Towers Watson noted that “large fleets both in composition and volume are experiencing rate increases in the upper single-digits to double-digits, in comparison to small corporate fleets experiencing rates in the mid-single digits.”

MarketScout’s 2023 analysis found transportation was the sector with the largest rate increase at +7.26%, with auto rates up 7.33% across all industries. MarketScouts 2025 shows another 6% increase for transportation fleets. The Council of Insurance Brokers & Agents reported that commercial property and casualty rates have risen for 25 consecutive quarters, with commercial auto insurance seeing quarterly rate increases between 5.9% and 10.4% from 2022 to 2023.

Marsh reported that commercial auto insurance premiums have increased by nearly 50% since 2020, with rising repair costs, increased accident frequency, and distracted driving claims as primary drivers. According to industry specialists at Hub International, commercial auto has experienced approximately five straight years of double-digit increases.

ATRI’s industry surveys, which directly polled carriers, underwriters, and insurance brokers, show the differential treatment: “low-risk” motor carriers with clean Safety Measurement System scores see 8-10% annual increases. New ventures and “average-to-marginal” carriers with SMS scores creeping toward intervention thresholds? 35-40% annual increases for three consecutive years.

Let me translate that in real numbers: If you launched your authority in 2021 with a $12,000 annual premium and have an average safety record with a few violations, you’re now staring at $22,000-$24,000 per truck. For a five-truck operation, you just added $50,000-$60,000 to your annual operating costs.

Alera Group’s 2024 Property and Casualty Market Outlook noted that trucking insurance used to cost $2,000-$5,000 per unit. Now costs are reaching $15,000 per unit. According to Alternative Risk Underwriting, ATRI found that 2022 operating costs increased by 21.3% compared to 2021, with operation costs averaging $2.251 per mile, the first time the per-mile cost exceeded $2.00.

The commercial auto industry is projected to finish 2023 at a combined ratio of 106.6, meaning insurers are paying out more in claims and expenses than they’re earning in premiums. That’s not sustainable. Combined loss ratios have exceeded 100% for 12 of the past 13 years. Something has to give, and historically, what gives is that premiums go up or carriers go out of business.

Nuclear Verdicts and The 967% Problem

ATRI’s analysis of 600 cases (2006-2019) found that verdict frequency jumped 335%, from 26 cases exceeding $1 million in the first five years to nearly 300 in the last five. Average verdict size increased from $2.3M (2010) to $22.3M (2018), a 967% increase while inflation grew 1.7% annually.

The 2023 U.S. Chamber study found that mean awards reached $ 31.8 million. Plaintiffs’ attorneys use “reptile theory”, emotional appeals to inflame juries beyond accident facts, pulling in carrier safety history, turnover rates, and unrelated crashes. When children are involved, verdicts increase 1,600% regardless of fault.

Operation Sideswipe

Between 2017 and 2020, federal investigators uncovered staged-accident fraud in New Orleans. “Spotters” identified 18-wheelers on I-10. “Slammers” packed cars and intentionally sideswiped trucks. Attorneys (who paid participants to stage crashes) referred “injured” parties for unnecessary treatment and surgeries to inflate claims.

Result: 52 indictments, 44 guilty pleas, $277,500 paid out for three specific staged accidents documented in indictments. Over 100 total staged crashes. Louisiana Insurance Commissioner Jim Donelon estimates accident fraud adds $600 annually to every Louisiana driver’s insurance, and similar schemes operate in New York and other jurisdictions.

One cooperating witness, Cornelius Garrison, was murdered execution-style in September 2020 before testifying further. His murder indictment alleged witness tampering, showing the stakes.

Third-Party Litigation Financing and the $3.2 Billion Problem

In 2022, litigation funders deployed $3.2 billion into U.S. lawsuits (16% increase). There are 44 active funders holding $13.5 billion in assets under management. They bankroll plaintiffs and law firms in exchange for settlement percentages, with returns averaging 25-30%, some reaching 124% interest.

A plaintiff gets $100,000 advance. Two years later, case settles for $1M. But the advance compounded at 30% now requires $169,000 repayment to the funder before the plaintiff sees anything. Result: plaintiffs can’t accept reasonable settlements because funders get paid first. Cases drag on. Trials increase. Verdicts maximize.

“Portfolio funding” allows investors to buy contingent interests in entire law firm caseloads, spreading risk while enabling aggressive pursuit of questionable claims.

Bloomberg Law exposed how sanctioned Russian billionaires with Putin ties used TPLF to fund U.S./UK lawsuits evading sanctions. Chinese TPLF firm PurpleVine IP financed multiple IP lawsuits against Samsung in U.S. courts.

SMS Scores = Insurance Quotes

FMCSA’s Safety Measurement System scores every carrier on seven BASICs (0-100 percentile scale, lower is better). Insurance underwriters treat SMS scores as primary risk indicators.

Industry data shows carriers with scores above intervention thresholds (typically 65%, 50% for hazmat/passenger) face premium increases of 20%+ versus carriers with clean scores. One bad inspection can mean “thousands of dollars in additional premiums per truck.”

A five-truck fleet at $15,000/truck with good SMS scores = $75,000 annually. One year of poor inspections drives scores above thresholds = $18,000-$21,000/truck = $90,000-$105,000 annually. That’s $15,000-$30,000 added operating costs.

Violations decay: weighted 3x in first 6 months, reduce at 13 months, drop off after 24 months. Carriers can challenge erroneous violations through FMCSA’s DataQs system.

Driver Qualification Risk

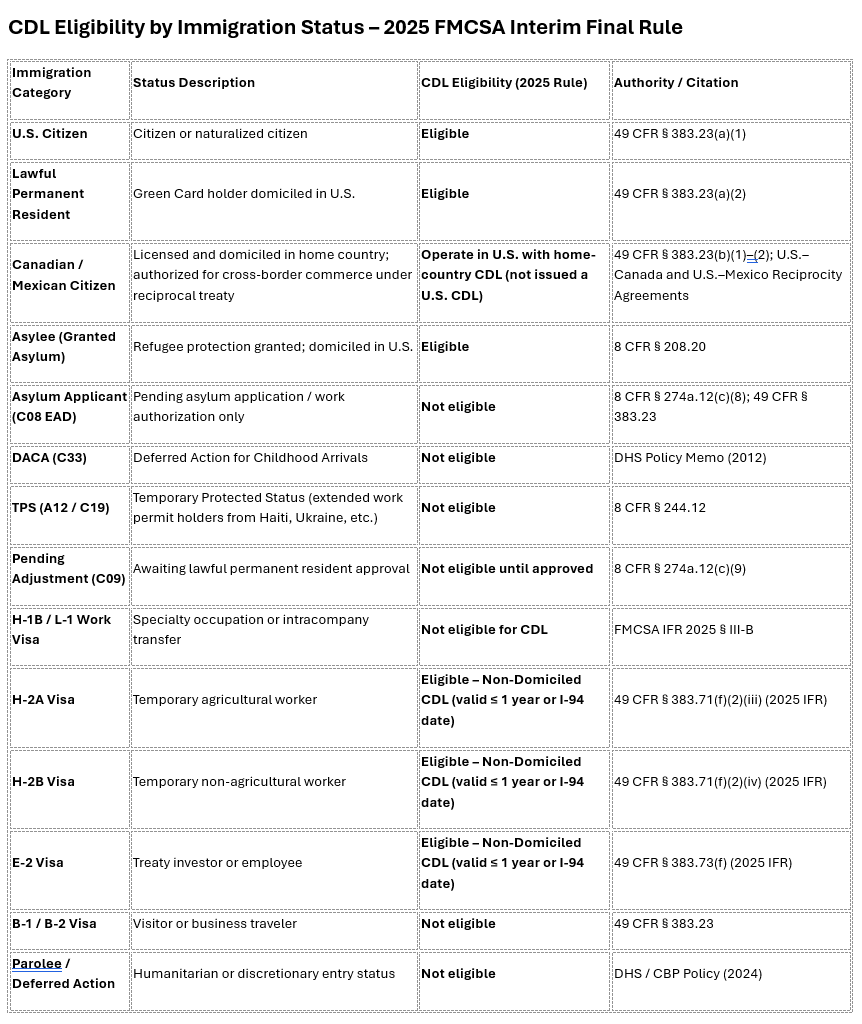

On September 29, 2025, FMCSA issued emergency rules restricting non-domiciled CDLs. Secretary Sean Duffy’s audit found at least 200,000 non-domiciled CDLs issued since 2019. California alone improperly issued over 25% of the reviewed licenses, some of which were valid for years beyond the holders’ lawful immigration status.

Simultaneously, FMCSA began strict English Language Proficiency (ELP) enforcement under 391.11(b)(2) effective April 28, 2025.

The Numbers:

One insurance executive estimates 10% of drivers on the road would fail ELP inspection today.

FMCSA reported 19,000+ ELP violations since April 2025, with 5,000+ out-of-service orders

J.B. Hunt analysis: 214,000-437,000 drivers (5-12% of CDL holders) could be removed over 2-3 years

I think the total at-risk population could exceed 600,000 drivers (16% of active drivers)

What Underwriters See and the Risk Exposure Calculation

Insurance underwriters live in a world of predictive risk modeling. When FMCSA targets specific driver populations, underwriters calculate: “How does this change our exposure?”

Driver Qualification File Scrutiny: If you employ drivers with non-domiciled CDLs that don’t meet new federal requirements, you’re operating with unqualified drivers under federal regulations. That’s not a minor violation; it’s a fundamental breach of Part 391 driver qualification standards.

An underwriter sees that and thinks: “If this carrier has an at-fault crash with one of these drivers, we’re facing allegations of negligent hiring, negligent retention, and regulatory non-compliance. That’s nuclear verdict territory.”

The Negligent Hiring Exposure: Plaintiff attorneys in nuclear verdict cases don’t just focus on the 30 seconds before the crash. As one plaintiff attorney stated in ATRI’s research: “I look at how he was hired, how he was trained, and how he was supervised.”

University of Tennessee research suggests correlation between carriers with ELP violations and worse overall safety records. Michigan State professor Jason Miller stated FMCSA should “devote more audit resources to target carriers with ELP violations to remove some of the most unsafe capacity from US roads.”

Insurance underwriters read that research. If your carrier accumulates ELP violations in SMS data, underwriters view that as proxy indicator for broader safety management failures. You’re not just dealing with language issues, you’re signaling your hiring, training, and compliance oversight may be deficient.

Geographic Concentration Risk: California, New Jersey, New York, Florida have larger non-domiciled CDL and immigrant driver concentrations. California-based carriers face:

Known non-compliance issues (state still doesn’t enforce ELP out-of-service)

Higher probability of employing drivers not meeting federal requirements

Increased regulatory enforcement scrutiny

Potential loss of $160M federal highway funds (doubling year two) if state doesn’t comply

Result: California-domiciled carriers with significant non-domiciled CDL populations get pushed to surplus lines or specialty high-risk programs, both substantially higher premiums.

The Broker’s Problem Marketing Your Risk

Insurance brokers “market” your carrier to multiple insurers. They prepare submissions presenting your operation favorably: clean SMS scores, solid loss history, proper safety programs, qualified drivers.

But when they submit your renewal, underwriters run your DOT number through SMS and see inspection history. Multiple ELP violations or inspection reports noting driver communication difficulties become part of your underwriting profile.

Underwriters at Travelers, Zurich, CNA, Canal, Great West, Progressive Commercial are discussing internal guidelines on carriers with significant non-domiciled CDL populations or ELP issues:

Automatic declinations for carriers with active non-domiciled CDL drivers not meeting new federal requirements

Rate surcharges of 15-25% for carriers with documented ELP violations in SMS scores

Enhanced driver file audits requiring complete driver qualification files before binding coverage

Mid-term policy reviews with cancellation provisions if carriers employ drivers with invalidated non-domiciled CDLs

Ken Adamo, Chief of Analytics at DAT Freight & Analytics, notes that the non-domiciled CDL policy could be “significant, especially if insurance companies start writing policies based on federal regulatory changes.”

That’s not speculation. That’s an industry analyst confirming: insurers will use this as an underwriting factor.

Expect these Immigration and ELP questions on 2026-2027 renewals:

How many drivers hold non-domiciled CDLs?

What percentage meet new federal eligibility requirements (H-2A, H-2B, E-2 visa holders)?

Have any drivers received ELP violations in the past 24 months?

What procedures verify English proficiency during hiring?

What’s your plan to replace drivers whose non-domiciled CDLs will be invalidated?

Do you conduct pre-employment English proficiency assessments beyond CDL testing?

Can’t answer clearly and demonstrate proactive compliance management? Your broker struggles to get competitive quotes.

Why Hiring the Wrong Drivers Costs You Everything

Poor driver qualification practices lead to increased crash risk, regulatory non-compliance, and potential exposure to nuclear verdicts, ultimately resulting in insurance unavailability.

ATRI’s nuclear verdict research identified driver-related factors resulting in judgments against carriers 100% of the time:

Phone use by drivers (verdicts for plaintiffs in every case but one)

Fatigue/hours of service violations

Lack of training/experience

Drug/alcohol issues

Poor hiring practices

When plaintiffs’ attorneys depose your safety director and HR manager after a serious crash, they’re asking:

“What was this driver’s work history before you hired them?”

“Did you verify their CDL status and immigration documentation?”

“How did you assess their English language proficiency?”

“What training did you provide on communication with law enforcement?”

“Were there any prior incidents or complaints about this driver’s ability to understand instructions?”

If you hired a driver with a non-domiciled CDL that didn’t meet federal requirements, or if you knowingly employed a driver who couldn’t effectively communicate in English, the plaintiff’s attorney just established negligent hiring. That opens the door to punitive damages, which aren’t covered by insurance.

Your $1 million policy might cover compensatory damages. It doesn’t cover the $15 million punitive award a jury tacks on because you “knowingly disregarded federal safety regulations in pursuit of cheap labor.”

The Capacity Paradox

When 200,000+ drivers are removed from the available pool, capacity contracts have historically reduced capacity, driving freight rates up and potentially improving carrier profitability, which can eventually moderate premiums for well-run carriers. Craig Fuller has reiterated that this is happening using the SONAR platform data.

That’s long-term. Short-term (2025-2027): If you’re caught employing drivers not meeting federal requirements, underwriting consequences far outweigh any freight rate improvements.

What You Should Do Before Your Next Renewal

Conduct an immediate driver file audit: Identify every driver with a non-domiciled CDL. Verify immigration status against new federal requirements. Plan accordingly.

Review SMS scores for ELP violations: Log in to the FMCSA SMS. Check for ELP violations. Document corrective action, training, or English classes, whatever demonstrates that you’re addressing it proactively.

Implement pre-employment ELP assessment: Don’t wait for roadside inspection to discover communication issues. Create an interview process that tests basic communication, sign recognition, form completion, and document completion in the driver qualification file.

Communicate with the insurance broker NOW: Don’t wait 30 days before renewal. Call today. Explain driver population composition. Ask how underwriters treat non-domiciled CDL and ELP issues.

Prepare for non-renewals: If you’re heavily reliant on non-domiciled CDL drivers who may not meet new requirements, some insurers may decline renewal. Know this six months in advance, not 30 days before the policy expires.

Document transition plan: Create written plan showing timeline for recruitment, hiring, training of qualified replacement drivers. Underwriters want to see you’re managing risk transition.

Trucksafe Consulting has a test, assessment and certification package for fleets which can be found here.

What This Means for the Industry

The commercial truck insurance market in 2025 shows no signs of stabilizing. Travelers and major carriers cite rising vehicle repair costs, modern trucks with advanced safety tech cost significantly more to fix. Driver shortages mean carriers compete for qualified CDL holders, sometimes compromising safety standards.

Combined loss ratios exceeded 100% for 12 of the past 13 years, insurers pay out more in claims/expenses than earned in premiums. Something gives: premiums increase or carriers go uninsured.

Smaller carriers hurt most. They can’t absorb 35-40% annual increases. Can’t self-insure. Can’t leverage captive insurance. Many calculate the numbers don’t work and shut down, reducing freight capacity, driving up rates, passing costs to consumers.

Now add the driver qualification dimension: carriers who haven’t addressed non-domiciled CDL and ELP compliance face compounding problems. You’re not just dealing with SMS scores and loss history. You’re dealing with fundamental questions about whether your drivers are legally qualified under federal regulations, and whether employing them exposes you to negligent hiring claims in nuclear verdict litigation.

Tort reform could address nuclear verdicts, but trial lawyer lobbies are powerful. TPLF disclosure requirements would bring transparency, but the industry resists regulation. Better fraud prosecution helps, but Operation Sideswipe shows how lucrative these schemes are.

For carriers, the answer is obsessive focus on safety, compliance, and documentation, now including rigorous driver qualification verification. Keep SMS scores low. Invest in training. Install cameras and telematics. Challenge erroneous violations. Hire drivers with clean records who meet all federal requirements. Maintain equipment religiously.

In 2025, your safety record isn’t just about keeping people alive, though that’s the only reason that should matter. It’s about whether you can afford insurance. And now, it’s about whether your driver hiring practices expose you to underwriting declinations, premium surcharges, and nuclear verdict liability that no insurance policy will fully cover.

The underwriting storm is here. Your SMS scores, your driver qualification files, and your hiring practices are now inseparable components of your insurance risk profile. The carriers who understand this and act proactively will survive. The ones who don’t will get their education at renewal time, if they can get renewed at all.